39 what does share buyback mean

Share buyback - what this is and what a company needs to do A buyback of shares is where the company buys some of its own shares from existing shareholders. There are three types of share buyback: Purchase of own shares. Share redemption. Share capital reduction by: cancelling shares. repaying share capital. reducing the nominal value of a share class. What is a share buy-back and how does it work? A share buy-back is a capital management strategy used by companies to return money to shareholders. In Australia, a share buy-back occurs when a company decides to repurchase shares from shareholders. These shares are then cancelled, reducing the number of shares on issue.

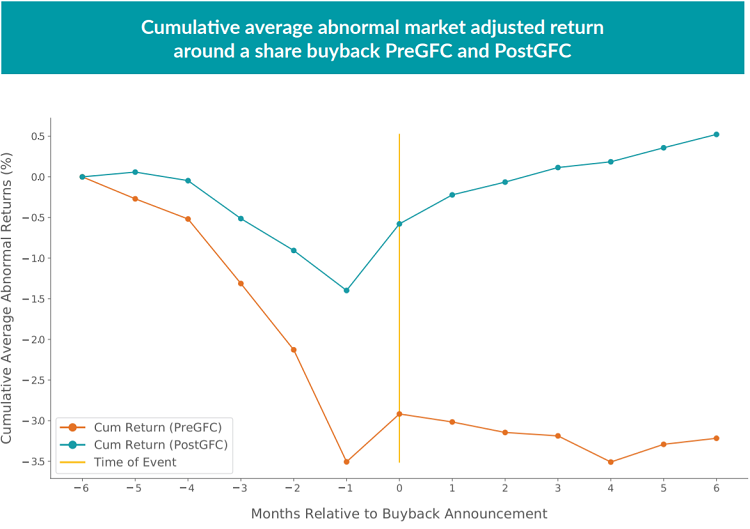

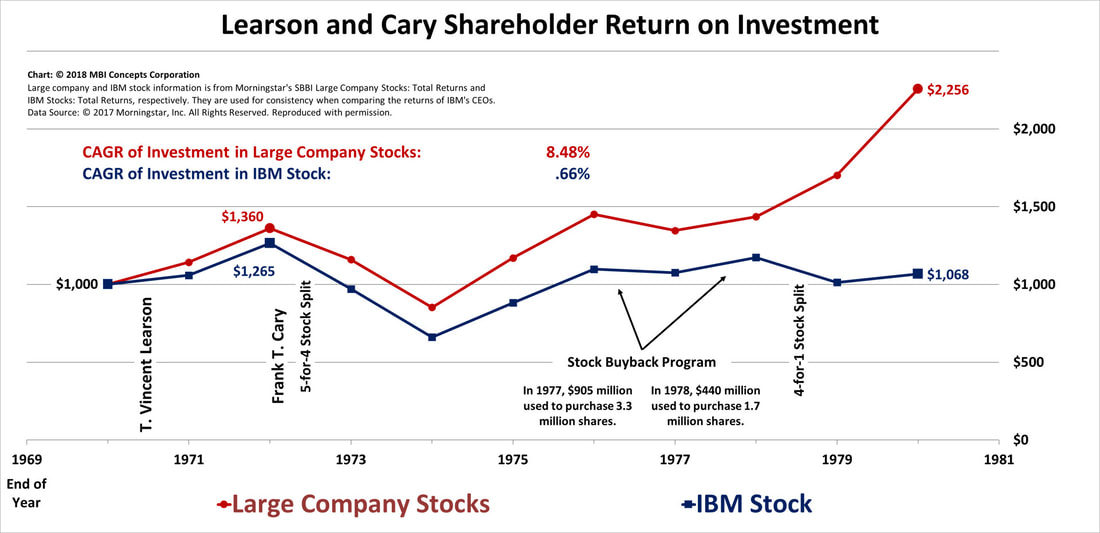

Share Repurchase - Overview, Impact, and Signaling Effect When a company buys back shares, it may be an indication that the company is facing very positive prospects that will place upward pressure on the stock price. Examples may be the acquisition of another strategically important company, the release of a new product line, a divestiture of a low-performing business unit, etc.

What does share buyback mean

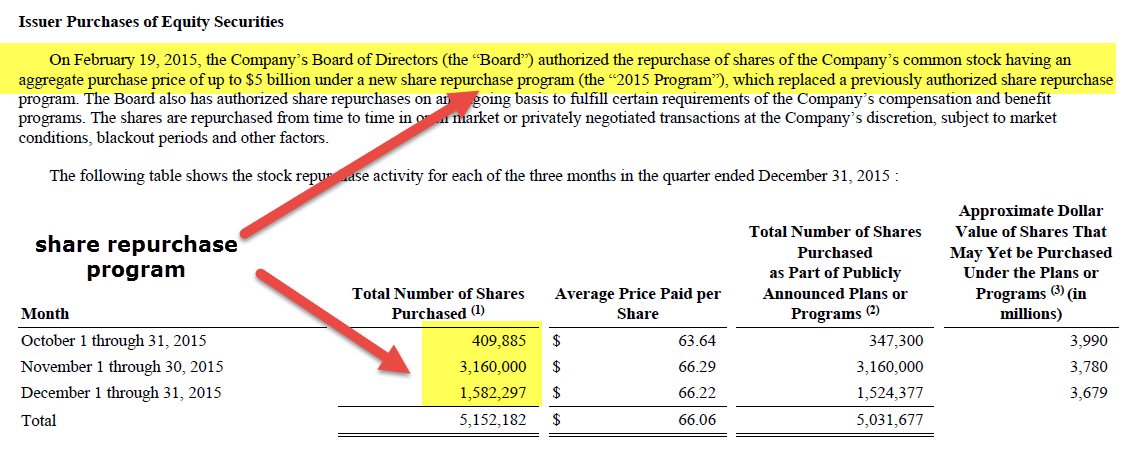

What is Buyback of Share | Share Buyback - Financegossips A share buyback or stock buyback or share repurchase is a corporate action where the company repurchase its outstanding shares from the shareholders of the company. Why Share Buyback. There are multiple reasons why a company decides to buyback its shares. We're going to discuss all the reasons behind the buyback of shares in the following points: › ask › answersWhat Does "N/A" Mean for a Company's P/E Ratio? Dec 29, 2021 · A buyback is a repurchase of outstanding shares by a company to reduce the number of shares on the market and increase the value of remaining shares. more Earnings Yield Definition and Example What Are Share Repurchases? | The Motley Fool Both terms have the same meaning: A share repurchase (or stock buyback) happens when a company uses some of its cash to buy shares of its own stock on the open market over a period of time.

What does share buyback mean. uk.advfn.com › stock-market › COINBuyback-and-burn: What does it mean in crypto? - ADVFN Jan 22, 2022 · 22/01/2022 4:00pm Cointelegraph. When considering price volatility in digital marketplaces, buyback-and-burn strategies in crypto offer long-term price stability and token value growth. › market › mark-to-marketWhat does TCS’ buyback mean for its stock Jan 13, 2022 · It has announced a buyback of up to 4 crore shares with the IT company buying shares at ₹ 4,500 per share. This is nearly 17%, premium compared to its last traded price of the stock on the NSE ... Share Buyback (Definition, Examples) | Top 3 Methods What is Share Buyback? Share buyback refers to the repurchase of the company's own outstanding shares from the open market using the accumulated funds of the company to decrease the outstanding shares in the company's balance sheet thereby raising the worth of remaining outstanding shares or to block the control of various shareholders on the company. How Stock Buybacks Work and Why Companies Do Them - SmartAsset Reducing cash outflows and countering a potential undervaluing of shares are potential reasons. A stock buyback can mean many different things for investors. Make sure to examine the situation carefully and potentially. Also consider consulting with your financial advisor if a company you own stock in does a buyback. Tips for Stock Investing

Share or Stock Buyback - Overview, Reasons and How do They ... Share or stock buyback is the practice where companies decide to purchase their own share from their existing shareholders either through a tender offer or through an open market. In such a situation, the price of concerning shares is higher than the prevailing market price. Stock Buybacks: Benefits of Share Repurchases A stock buyback, also known as a share repurchase, occurs when a company buys back its shares from the marketplace with its accumulated cash. A stock buyback is a way for a company to re-invest in... What Stock Buybacks Mean to Investors | InvestingAnswers Also called a share repurchase program, stock buybacks are a way a company returns wealth to the shareholder by purchasing outstanding shares of its own stock. A stock buyback is generally conducted in one of two ways: buying shares in the open market over time or tendering an offer to existing shareholders to buy shares at a fixed price. ELI5: What does "share buyback" or "share repurchase" mean ... It literally means what it says on the tin: the company is buying back the shares from their shareholders. Usually, they'll buy it back at a price that is significantly higher than the current share price so that investors would be willing to sell.

What Is A Stock Buyback? - Forbes Advisor A stock buyback is when a public company uses cash to buy shares of its own stock on the open market. A company may do this to return money to shareholders that it doesn't need to fund operations... › terms › sShare Repurchase Definition - investopedia.com Dec 15, 2021 · A share repurchase, or buyback, is a decision by a company to buy back its own shares from the marketplace. A company might buy back its shares to boost the value of the stock and to improve the ... › amazon-stock-splitWill the Amazon Stock Split Boost the Online Titan's Shares? Mar 16, 2022 · Amazon, the world's fifth largest company by market cap at $1.42 trillion, has announced a 20 for 1 stock split and $10 billion share buyback program. Stock Buybacks - What It Means When a Company Repurchases ... Stock buybacks, often referred to as share buybacks or share repurchases, are repurchases of stock in the open market by the issuing company. That's right, if Apple announces a share buyback, it means that the company plans on using some of its mounds of cash to buy its own stock back.

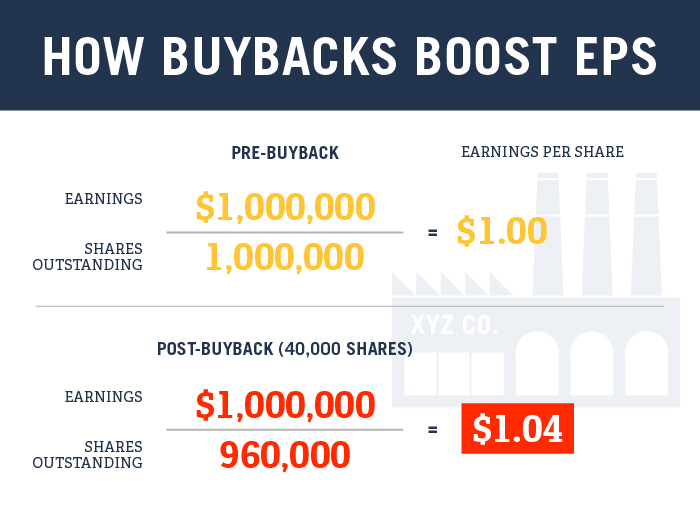

What Is a Buyback? - The Balance A stock buyback occurs when a company buys outstanding shares of its own stock with excess cash or borrowed funds. A buyback increases the value of outstanding shares. It reduces the number of total shares on the market, which increases the earnings per share (EPS).

finance.yahoo.com › video › amazon-stock-jumps-20-1Amazon stock jumps on 20-for-1 share split, buyback announcement Mar 10, 2022 · Amazon stock jumps on 20-for-1 share split, buyback announcement ... But that would take effect in June if it does indeed happen. ... join Yahoo Finance Live to discuss the market rally and what ...

60 second guide: Share buybacks - CommBank Share buyback explained A buyback is when a company offers to re-purchase some of its shares from existing shareholders. The net effect is a reduction in the total number of a company's shares on issue.

Bank share buybacks: What they mean for you The buyback price will comprise two components - a capital component of $21.66 and a fully franked dividend, which will be the difference between $21.66 and the final sale price, minus the tender discount.

Share Buybacks: What It Means And How It Impacts Investors Definition of 'Share Buyback' A share buyback, or repurchase, is a move by a listed company to buy its own shares. This can be from the open market, issuing a tender offer, or arranging for a private buyback from a shareholder(s).

How Stock Buybacks Work | The Motley Fool The effect of a share buyback is that there will be fewer shares after the buyback is completed. This may sound like a very obvious statement -- after all, if a company has 1 million outstanding ...

Share Buyback - Advantages, Disadvantages, and How Does It ... Share buyback The share buyback is when companies buy back their own shares from the shareholders. There are multiple logics and methods that why the companies opt for buying back. However, shareholder's approval is required for the successful execution of the transaction.

What is a Stock Buyback? Definition & Benefits of Share ... What is a stock buyback? A stock buyback (also known as a share repurchase) is a process when a company buys back its shares from the marketplace, therefore reducing the number of shares that are outstanding. Because there are fewer shares on the market, the value of each share increases, making each investor's stake in the company greater.

What is a Share Buy-Back & How Does It Work? | Canstar A share buy-back happens when shareholders are invited to sell some of their shares back to the company. Here's how it works. Banking Loans Home Loans Car Loans Personal Loans Margin Loans Account & Transfers Savings Accounts Transaction Accounts Term Deposits International Money Transfers Credit Card Products Credit Cards

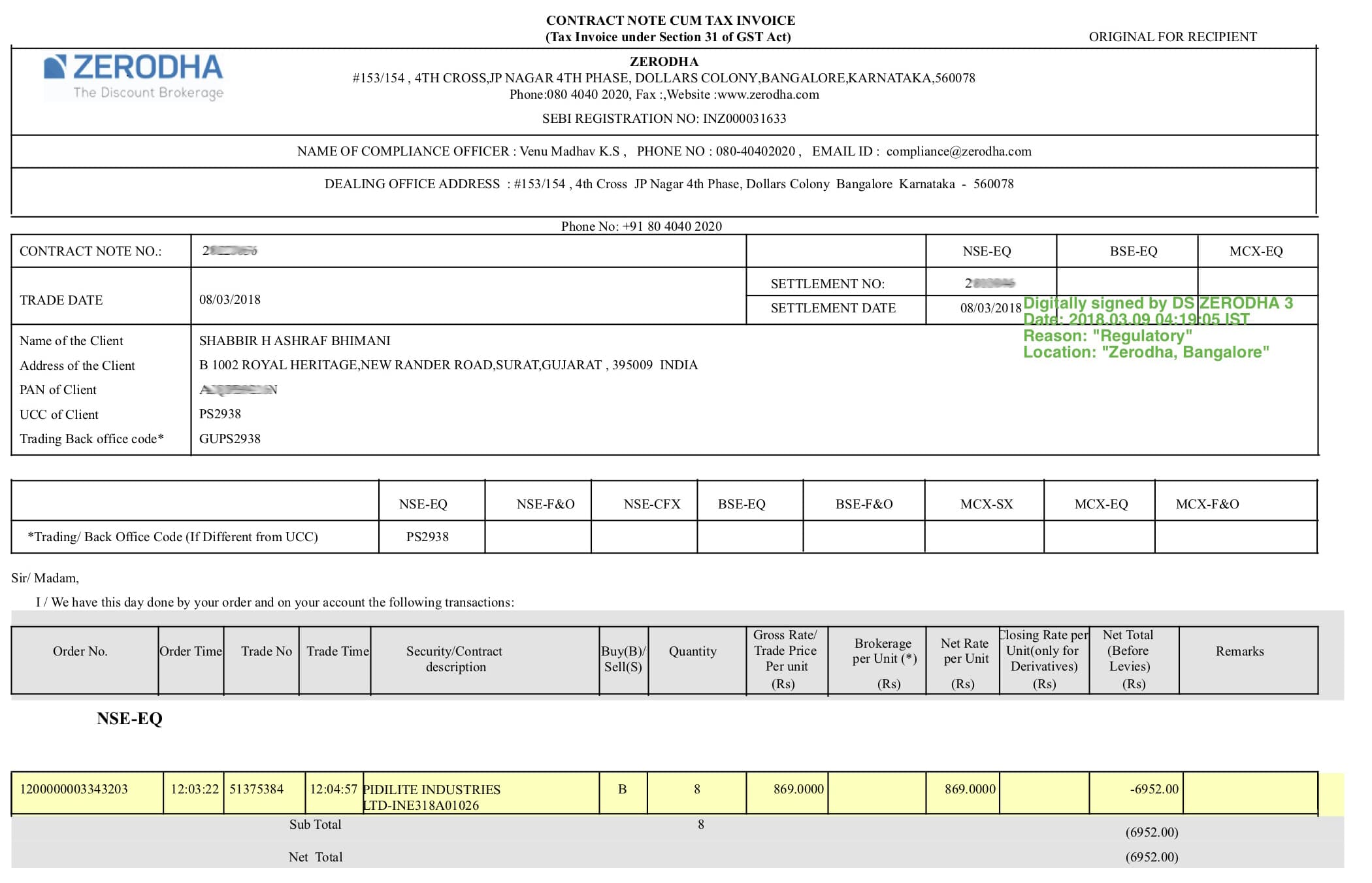

economictimes.indiatimes.com › markets › stocksbuyback: Share Buyback: What it means for retail investors ... The company announces a share buyback worth a specified amount and at a price per share indicating the number of shares it wishes to purchase back from shareholders. For example, Wipro announced a Rs 11,000 crore buyback offer at Rs 320 per share to purchase 34.37 crore shares held by the shareholders. Buyback amount set aside for retail investors.

What is a share buyback? | Share repurchase definition | IG SG Share buyback, or share repurchase, is when a company buys back its own shares from investors. It can be seen as an alternative, tax-efficient way to return money to shareholders. Once shares are repurchased they are considered cancelled, but they can be kept for redistribution in the future.

What is a Share Buyback and Why Do Companies Do it ... What is a Share Buyback and Why Do Companies Do it? They can invest it. They can keep it for a rainy day. They can hand it over to shareholders either as cash in the form of a dividend or buy the shares back.

What is a Share Buyback? | Purpose, Example, Analysis ... Share buyback is an alternative means to compensate shareholders as opposed to dividends. When a company buys its shares, the number of outstanding shares in the market is reduced, hence the stake of the shareholders in the company is increased.

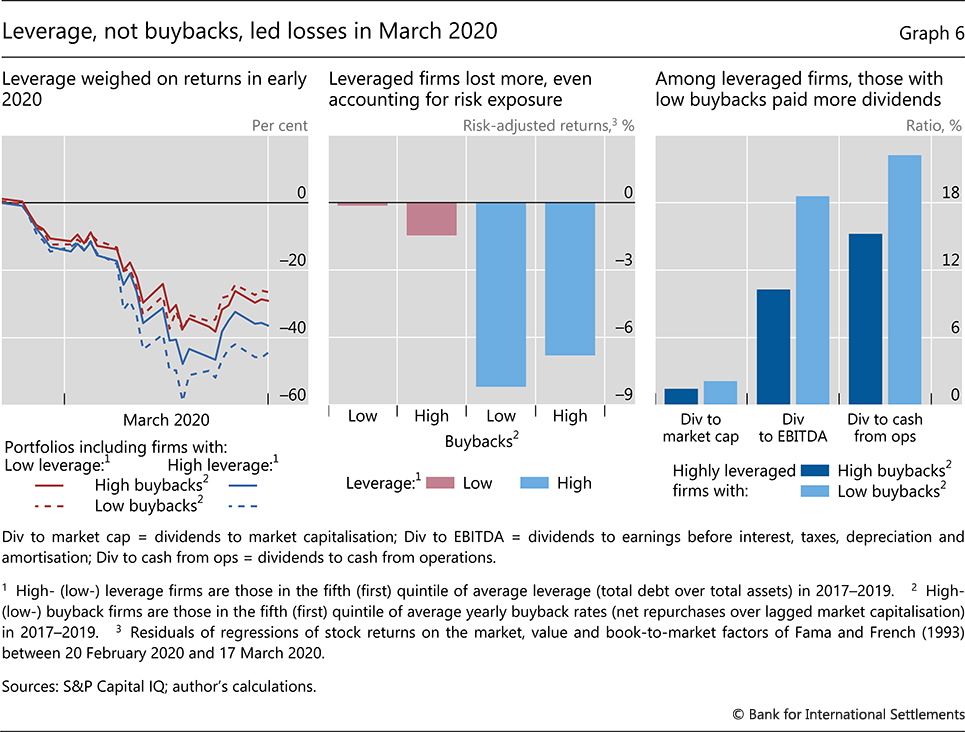

Stock Buybacks: Why Do Companies Buy Back Shares? A stock buyback affects a company's credit rating if it has to borrow money to repurchase the shares. Many companies finance stock buybacks because the loan interest is tax-deductible .

Share Buybacks - The Motley Fool UK As investing jargon goes a share buyback is one of the simplest terms. It's simply a company buying back its own shares. It can do this in one of two ways. The first, and by far the most common, is...

What Are Share Repurchases? | The Motley Fool Both terms have the same meaning: A share repurchase (or stock buyback) happens when a company uses some of its cash to buy shares of its own stock on the open market over a period of time.

› ask › answersWhat Does "N/A" Mean for a Company's P/E Ratio? Dec 29, 2021 · A buyback is a repurchase of outstanding shares by a company to reduce the number of shares on the market and increase the value of remaining shares. more Earnings Yield Definition and Example

What is Buyback of Share | Share Buyback - Financegossips A share buyback or stock buyback or share repurchase is a corporate action where the company repurchase its outstanding shares from the shareholders of the company. Why Share Buyback. There are multiple reasons why a company decides to buyback its shares. We're going to discuss all the reasons behind the buyback of shares in the following points:

0 Response to "39 what does share buyback mean"

Post a Comment